Independent Insurance Agency 2024: “No BS” Web & Mail Approach

February 2024

If there is one industry that I think would benefit from marketing smelling salts, it would be independent insurance agency owners. We have worked with many agency owners and so many of them fail to grasp the need for something more than a one-off plan. The opportunity is so great, and the effectiveness of national agency marketing is so bad, that it’s a shock to us that more independent agencies don’t actually have a plan. For some reason, in this market vertical, it’s not that they have poor plans or misguided plans, we find that most have NO plans. This blog is meant to provide the best of our experience, for over 20 years, for how to become relevant, not overnight, but within one (1) year. There are no overnight, just-add-water, marketing solutions. However, if you were to follow our experience-driven steps, you would “crush it” but most agencies seem adverse to doing anything, and that is where we will start.

Most Independent Insurance Agencies Owners are Lazy

No, I did not say “market or labor challenged” “too busy or distracted” or even “unfamiliar with web/mail marketing”… I said, “lazy”. I could have used the euphemism of “comfortable”, but I don’t think that truly sends the right message or matches what we’ve come across (not directly, but indirectly… I can explain another time). When small insurance agency owners are actually motivated, they often throw (big) money at unmeasurable and ephemeral marketing tactics such as radio ads, billboards, Google/Facebook ads, and even conventional saturation mail. So, why am I starting this write-up by insulting you by using “lazy”? First, that is our unapologetic and direct experience. We see owners who have built up their agencies and then glide because they reached a cruise-control altitude of solid premiums. That is simply the majority of what we have seen.

I give credit to independent insurance agency owners who spent several years attending chamber meetings, showing up at pancake breakfasts, setting up tables at the local business expo or street fair, sponsoring golf outings, chasing down referrals, taking calls on weekends, going the extra mile for friends-of-friends and extended family members, committing to BNI meetings, etc., yet ultimately, they level off. It’s not all wrong… isn’t that the goal of growing a small business? Do you want to spend more time on the golf course, with grandkids, at the VFW, going to Florida? You’re not just building a business, right? You’re building a life! Also, many of them inherited the business from other family members, so why should they work so hard? Wasn’t the hard work already done?

Even though insurance is often viewed by consumers as a commodity – not unlike propane, bread, or bottled water (don’t believe me? Just check the ingredients) – one could argue that insurance agencies have less cyclical bumps and enviable regularity with cashflow premiums, even despite large overhead fixed costs. However, if you don’t have even a modestly appropriate financial buffer from the agency to engage in mild, ongoing marketing, then don’t. You and your bookkeeper need to sit down and review your P&L reports; and, collectively, you both find out “where is the money going?” To support you in marketing, we’re not putting our fingers into financial dams. Get a grip on your monthly profit and loss; once you know you’re on solid ground, then give us a shout.

With stable insurance agency businesses, the problem we see is a lack of future planning. Put another way, what got your agency to this level won’t sustain you. Ironically, it’s almost a “marketing insurance” problem. You haven’t bought “marketing insurance” to solidify your gains. Specifically, you didn’t build in an annuity of ongoing referrals, combating natural and unexpected customer attrition, building a fortress in solidifying your “backyard” (your regional) so that in a prophylactic sense, you would make the “cost of entry” very expensive if not distasteful for another independent agent to enter your turf. There is no coasting – you are either going up or going down, and at this level, most agencies are going down because they aren’t using the correct barometers to gauge mark relevance.

Please go back a few paragraphs and re-read the line about “coasting”… there is no such thing as coasting: you are either going up or going down. Our job at Cornerstone Services, Inc. is to offer a plan to go up so that you accomplish specific and measurable goals:

- your attrition rates are under industry standard attrition rates;

- you continue acquiring new customers; and,

- you maintain a year-over-year upward trajectory.

To attain these goals does not require enormous cash reserves for marketing, but it would require an intelligent web and direct mail strategy, enacted over at least one year. Our job is simple: it is to “purchase” cash and awareness. “Cash” means we want you to have new (and happy) customers with attractive premiums and with the statistical likelihood of minimal claims. “Awareness” means that when you need people to call for quotes; when people call around, they might get 2 or 3 quotes… you need to be in that 2 or 3 group. You need to be one of the firms that gets called.

People selling you billboard ads have only one goal in mind: sign a 6 month to 12 month contract. Same with radio: sign up for one of various packages that are tiered on levels of audience. Online advertising is even more impersonal. Yes, these will all work at some level, but you often can’t measure them – you can only infer their successfulness. At the end of the day, after 6 months or 12 months, you are alone in the room. Can you accurately say that these approaches moved the needle?

So I concede this: it might seem to be a daunting task to pull off a significant marketing approach on one’s own. This blog is intended to give you concrete steps to do just that, whether you are interested in contacting us or not. But I also caution you – don’t waste time on silly, AI-generated blogs that provide sweeping, macro-level, broadstroke guidance; these are “bread sandwiches” containing no marketing protein. With or without us, I’m giving you information that we obtained organically and didn’t cross verify with stupid-ass infoweb blog sites. I’ve seen insurance marketing go very well and also really wrong. Bidden or unbidden, you can learn from our mistakes and successes.

CRST’s Specific Steps for Our Independent Insurance Agency Marketing

Here’s the “white meat” of the turkey, and here’s what we would do to help you:

- Assess You Online Web Presence;

- Website Health Checkup & Set-up for Web Analytics;

- Gardner Positive Reviews/Counter Negative Reviews;

- Solidify Your Existing Customer Base;

- Outreach to the Watering Holes;

- Identify Insurance Market Niches;

- Enact Direct Mail Communication with Existing Customers;

- Launch Direct Mail Marketing Campaigns for Prospective Customers;

- Review Marketing Program Results Periodically with Benchmarks; and,

- Establish SOPs to Sustain Decided Upon Agency Objectives.

To be fair to us, we’re not going to tell you everything. This blog is to get you to ask good questions and help you solve your own problems if you don’t want to hire a firm such as Cornerstone Services, Inc. Nonetheless, let’s walk through each above step one-by-one:

Assess You Online Web Presence

This is the first thing my staff does when we get hired. We look at how you are showing up? Do you even show up? Here are some (not all) of the specific things that we review:

– Reviews (BBB, Google, Yelp, Facebook, among many others)

– Uniform branding and correct set-up on other sites (e.g. local chamber of commerce, trade associations, social media listings, etc.)

– Claiming of Social Media site profiles (for example, did you claim your Manta.org profile?)

– Backlinks (who is recognizing you elsewhere, or, are you a “web island”?)

Website Health Checkup & Set-up for Web Analytics

At Cornerstone, we usually send over a 1-page “Web Health Checklist”. Here’s how your website ranks on web search engines (esp. Google):

– Google Ranking for keywords

– Compliance with Google SEO protocols

– Backlinks (who is recognizing you elsewhere, or, are you a “web island”?)

– Site speed and responsiveness

– Review of generic stock image use and amount of throw-away text/copy

– Website security and vulnerabilities

Gardner Positive Reviews/Counter Negative Reviews

We next want to ensure that you look good, and the best way to do this is to counter negative reviews and then “outweigh” any negative reviews by soliciting positive reviews. There is both an immediate approach and a long term approach for garnering positive reviews. There are few quick fixes, but there are modestly priced workable approaches. This doesn’t have to be hard, but it does have to happen. If you don’t counter online negative reviews, you allow weeds to grow in your garden. And, since you often can’t kill the weeds, we can nonetheless out number them with positive reviews. The key is to have a plan,then work the plan.

Solidify Your Existing Customer Base

Next, we need to make sure your clients remember you. One of the biggest insurance problems we see with independent agencies is that they don’t connect with their existing base. The purpose is multi-fold, so we want your customers to do the following, below, and we will be using street smart direct mail tactics to do this:

– Remember you (and not get wooed away)

– Remember that they like you (and not get wooed away)

– Refer their friends and family to you (and you need to be remembered for that to happen)

– Pay their bill online if not simply answer stupid questions online instead of calling you

– Contact you when there are changes in their lives requiring insurance needs

Outreach to the Watering Holes

Along with proactively reaching your customers, we also want to shore up opportunities with other “watering holes” in your area. Here, we would build a custom but small data of firms to whom you would mail quarterly with potentially relevant information. We define “watering holes” as places that would be in the position to refer customers to you, and they are often located at the places where people make big changes in their lives. Consider:

– Local real estate offices

– Local CPA/accounting firms

– Local bookkeepers and financial planners

– Local Contractors and construction firms (new home builders)

– Chambers of Commerce

Identify Insurance Market Niches

We still think insurance is a commodity, so once we establish that your current customer base likes you and will stay with you, we want to examine “how can we get more of them?” Often, this comes down to looking at home and auto policies and seeing what else you could offer. If you are primarily a Nationwide Insurance Agency, you might not be competitive in motorcycle insurance, so we wouldn’t promote that on your website or via a direct mail campaign. However, you might be very competitive in various types of business insurance and there might be specialty niches outside the immediate area. Maybe you understand the needs of mobile home insurance? Perhaps you get boat insurance and what’s required for out-of-state use and know the marina requirements.

Here, we would need to have a conversation and we’d need to talk through where you think you could make immediate inroads. The worse thing, I feel, we could do is do what most insurance marketing efforts do – market the commodity of insurance like a commodity. We need to make, or remake, you into an expert where you have knowledge and premium margin.

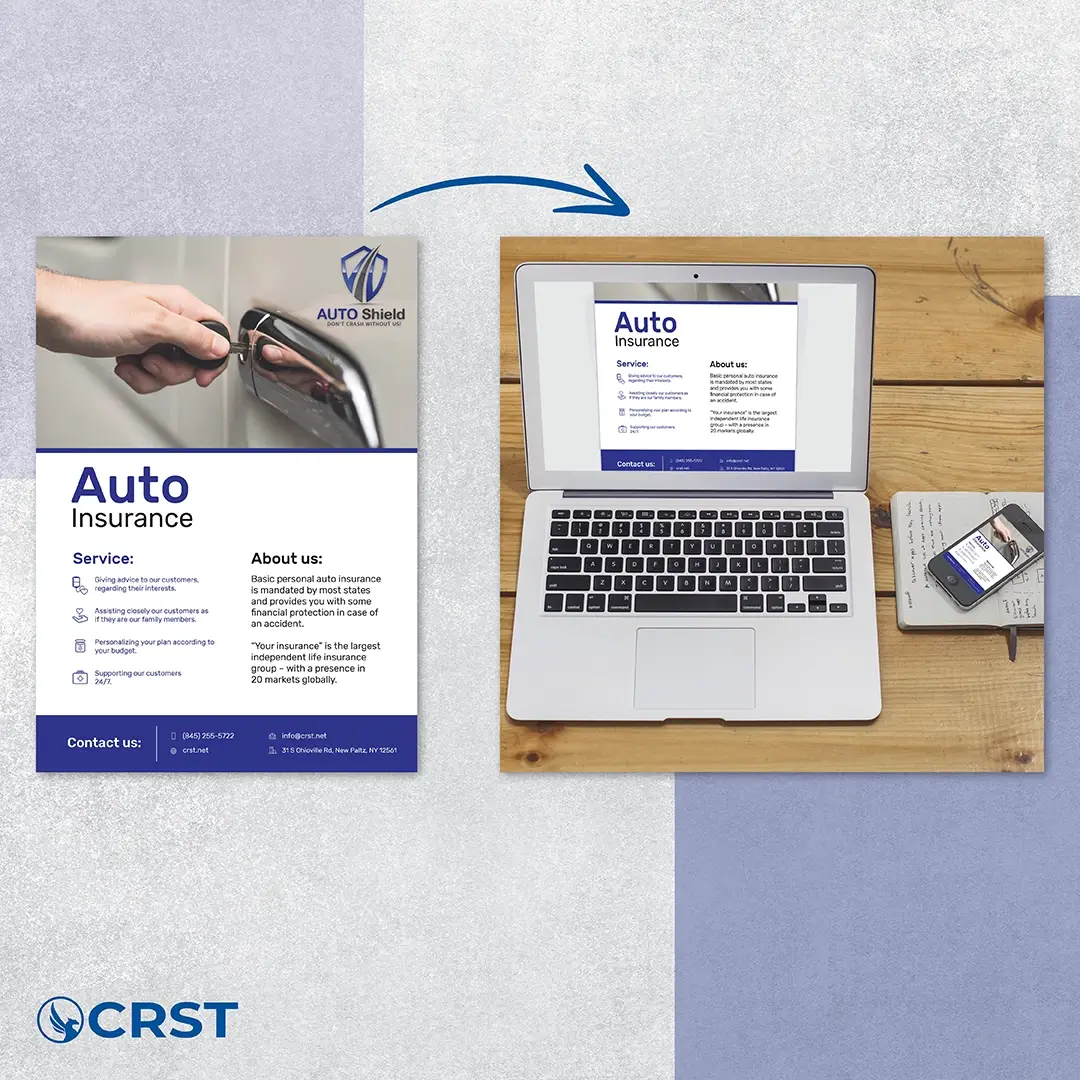

Enact Scheduled Mail/Email Communication with Existing Customers

Here, at Cornerstone, we shine. We know that because insurance is a commodity, your customers are not buying insurance each year, they are buying you. We are unique in comparison to most insurance marketing firms because we have so much direct mail experience, so our approach is not generic. We do not have “insurance packages” – that doesn’t work.

We know, for example, that we have only 1 – 3 seconds to grab your recipient’s attention. How do we make those 1 to 3 seconds count? We need to make them feel special and remind them that they made a good choice in being with you. I can’t tell you everything that we do, but I can also share with you (in the spirit of being super helpful) some of the things we don’t do. So, here is a partial list of direct mail/email Do’s and Do Not’s:

– Don’t celebrate every single holiday with a social media post (OMG, what are you thinking? Cinco De Mayo = probably NO; First Day of Spring = probably NO. Thanksgiving = probably YES)

– Don’t remind people of taxes or financial problems

– Don’t tell your customers with unabashed directness how great you are (you do it indirectly)

– Don’t invite them to a tradeshow or an event that is of little to no interest to them

– Don’t offer discounts or special “deals” (ugh! You are better than this – don’t just give it away; more on this if you call us)

– Do thank your customers for years of loyalty

– Do invite them to relevant activities that help with financial education and well-being

– Do schedule annual wellness check-ins

– Do contact them about local partnerships you have

– Do gift them something unique (e.g. “contact us for two free tickets per home to see the Nutcracker this December”; even if they can’t go, you get credit for the offer).

We want to use email marketing, for existing clients, to drive them to the website for relevant topics. We can’t both raise awareness and educate your customers with direct mail… not when we only have 1 to 3 seconds. However, if they like you (remember, above, how we established that they need to like you!), they should find relevant topics, well, relevant. Here are some email marketing ideas and we would use email marketing as a teaser to drive people to your website with relevant insurance topics. If they are interested, they’ll go to the website.

You might have paused on the word “blog” above. And, you might be forgiven if you rolled your eyes. I can just hear your silence speaking aloud “oh, great… another thing I have to do or learn how to do.” Well, we can help with that and we won’t be using Chat GPT 3.5 or 4.0 to crank out crappily generic blogs, jeopardizing the overall value of the good work we’re trying to do. Simply, an unspoken side benefit of drive people to your website with both direct mail and email is that Google loves it. You start ranking towards “Page One” without having to pay for SEO or Google Adwords.

We, at Cornerstone, are going for organic SEO while at the same time engage your current customers with positive, relevant content. The bonus benefit is that other potential customers might also want to know what you do, how you do it and why what you’re talking about is important. In the Google-based world, your potential customers are everyone. This is the “multiball” benefit of using honest, natural direct mail and email marketing – you aren’t just driving your customers to your website, you’re raising your profile in the search engine world and brightening your lights for prospects to find you as well. And, they will.

Launch Direct Mail/Email Marketing Campaigns for Prospective Customers

Again, here is a real difference between CRST/Cornerstone and other insurance marketing firms. We use direct mail to drive your web ranking (without your paying Google or anyone else for that!) and, we establish an on-going approach to woo new customers to you. To be clear, we’re not going to do most of this via online marketing – we’re focusing on direct mail because we can measure that better than other marketing options. And, we can “adjust the dials” better, and redirect our approach if not target new areas. When you sign a billboard contract, you are contracted to a billboard (or group of billboards) in specific areas. Here again, we’re looking for Google traffic, too. We want prospects to check you out. If this is done on a coordinated and scheduled basis, you never, ever have to pay extra for SEO services and Google Adwords. Facebook marketing (which we don’t like) also becomes irrelevant.

If of interest, here are website blog topics (monthly or quarterly) that we might use in on-going email marketing teasers to drive your customers to back to your website:

- 2024 changes in automotive insurance laws

- Benefits of Driver safety training & how we can help

- Taking inventory of jewelry & assessment for insurance (i.e. Appraisals are meaningless if you don’t provide immediate coverage!)

- Insurance + Marriage, Insurance + Divorce

- 5 Immediate Tips for Lowering Homeowner Insurance

- Do I need Flood Insurance? What to Know…

- Life Insurance Options

- Why Our Agency Doesn’t Carry Health Insurance

- Benefits + Pitfalls of Insurance Bundling

- NYS Boating Laws & Insurance Implications

- Mitigating a DUI/DWI Costs and Insurance

- Biggest Surprises Homeowners Realize about Lack of Coverage

- Insurance Benefits of Setting Up Cameras

- Understanding Deductibles

- “Small Business 101” Basic Insurance Options

Review Marketing Program Results Periodically with Benchmarks

If we build your website, you’re going to get Quarterly Reporting. You want this, and, we want to give you this. But whether it is our website, or, working with a website done by others, we will need to use the site for measurement for other efforts are going. This is an important point because we don’t believe in “hope”. Insurance marketing is not an aspirational endeavor – we’re either seeing results or we are not. We need to agree upon what success looks like, and, we need to agree upon what lack of success looks like. Periodically, we (at Cornerstone Services, inc.) need to check in with you and make sure we’re on track. If adjustments are needed, then we work together to make adjustments.

Establish Marketing SOPs for Agreed Upon Agency Objectives

Coming full circle, we really do want you to go play more golf and/or spend time with your grandkids. However, we want you to set up a plan-of-action that will maintain the trajectory of your business in a direction that allows you to know that there is sustainability with the agency. Even if your agency is matured and you “can’t handle new customers”, you’re still going to want to show a positive direction and establish value in the event that you merge or get acquired. Remember, there is no such thing as coasting… you’re either going up or down, but not staying at the same level each year.

The Marketing SOP (Standard Operating Procedures) look like the following, and we’re going to encourage you to develop them for year-over-year success so that other people in your agency can ensure this success. We want to free you and not tie a boat anchor to your agency. So, an initial SOP question might be “If not you, who?”. Here are other good SOP marketing questions to answer:

- What is our marketing calendar? What do we put on the marketing calendar and how often should we mix that up?

- What is our new customer goal? How often should we change that goal? What happens if we do or don’t reach that goal?

- Who writes blogs? How long should blogs be? How do they get posted?

- Who is in charge of Google Analytics? How often do we review Google Analytics? What is considered successful and not successful for web statistics?

- Who makes follow-up calls for client satisfaction after a new policy is written? How and when do these calls get made?

- Do we need to engage in cyclical marketing? When do we need to engage in cyclical marketing?

- Who does our Facebook posts? How often and how do such Facebook posts get done?

I hope you found this write-up helpful. We didn’t want to give you generic guidance because each independent insurance agency is unique, and yet, each agency has the same objective. If we can be of help, it likely starts with a conversation and not a phone call to (845) 255-5722. If you just want an estimate, sure, just email info@crst.net and you’ll get that. If you’re looking for a longer term plan, then we can help with that as well.